Table of Contents

Introduction

The rise and fall of GameStop (GME) in the stock market remains one of the most discussed financial stories of the past. The company transitioned from a stressed video game store into a meme stock marvel, driven by retail investors on platforms like Reddit’s Wall Streeters’. Today, GameStop faces a new reality: to live and thrive, it must adjust to the fast-developing digital landscape. As we look toward 2025-2030, investors need to calculate the company’s predictions for shifting its business model from physical stores to digital systems and the potential effects on fintechzoom gme stock forecast, stock prices, and estimates. This article explores GameStop’s future, examining possible digital changes and their long-term impact on the stock.

GameStop’s Current Position and Recent Performance

Financial Health and Stock Performance

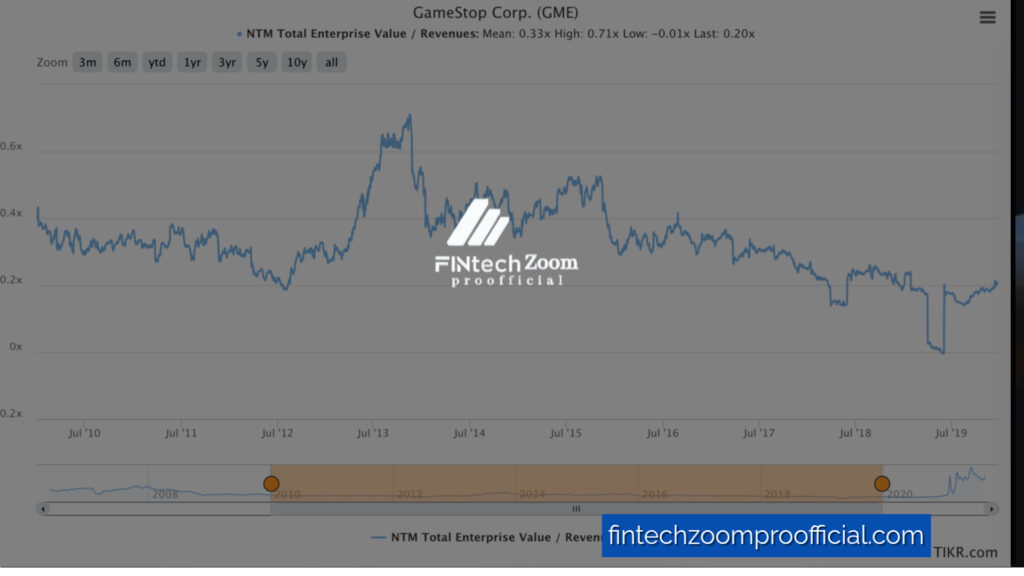

In 2024, GameStop’s financial health reflects a company at a crossing. After huge instability due to its meme stock surge in 2021, GME’s stock has seen large fluxes. Recent reports show that GameStop’s traditional retail model struggles as physical game sales decline. According to FintechZoom GME stock price data, the stock has released suggestively from its meme-stock highs, trending down by 32.1% from early 2024 levels. Analysts from FintechZoom project a bearish outlook, with an average price target of $5.60 for GME, primarily driven by reduced incomes and increased competition from digital gaming platforms.

Market Sentiment and Investor Concerns

Investor sentiment near GME has shifted from the energy of its meme stock era to doubt its ability to pivot to a workable, digital-focused business model. As investors contend with FintechZoom GME stock forecast, many question whether the company can genuinely boom in the digital age. The company’s leadership has highlighted reform efforts, but the challenges posed by digital-first competitors like Steam, Epic Games, and Sony are considerable.

Pivoting to Digital: GameStop’s Strategic Shifts

Efforts Toward a Digital Transformation

GameStop’s management has documented the need for a digital change and has started shifting away from its trust in physical stores. The company’s leadership protest, including selecting Ryan Cohen, former Chewy CEO, pointed to injecting fresh ideas into the company. While some steps have been taken to reduce the retail mark and expand online actions, more is needed to convince investors that GameStop can be a serious player in the digital space.

GameStop’s ability to tap into growing markets like esports, cloud gaming, and digital asset trading is critical to this transformation. While the company has made forays into the world of NFTs and blockchain-based gaming, these creativities remain in their start, and much hinges on whether they can scale in the coming years. FintechZoom GME stock prediction highlights the importance of these projects, as successful execution could suggestively alter GME’s course by 2030.

Potential Growth Areas in the Digital Sector

Esports and Online Gaming

The global esports market, valued at over $1.38 billion in 2022, presents a well-paid growth area for GameStop. Leveraging its strong gaming brand, GameStop could partner with esports governments to develop a strong presence in the online gaming community. This move could also boost the company’s digital sales and allow it to build an ecosystem of loyal customers. FintechZoom GME stock forecast projects that a severe push into esports could drive growth, mainly as younger generations hug competitive online gaming.

Subscription Models and Cloud Gaming

Cloud gaming is another growing market with the potential to redefine how players access games. Services like Microsoft’s Game Pass and Sony’s PlayStation Now have transformed the gaming site by offering gamers access to extensive game libraries on a subscription basis. GameStop could benefit from joining these services or creating its subscription-based platform. FintechZoom GME stock prediction suggests that this shift could help GameStop tap into the growing trend of digital game eating, possibly steadying the company’s finances by 2030.

Stock Forecast 2025-2030: Optimism Amidst Uncertainty

Long-Term Forecast for GME Stock

Contempt its challenges, GameStop has a loyal investor base that believes in the company’s potential for a digital transformation. FintechZoom GME stock forecast for 2025-2030 is diverse, with both optimistic and traditional plans. On the one hand, the stock could see a revival if GameStop can successfully pivot to digital and expand its income streams through online sales, payments, and esports. An optimistic situation suggests the stock could stabilize around $30-40 per share by 2030. On the other hand, if the digital strategy fails or the company continues to rely too profoundly on its declining retail operations, FintechZoom GME stock prediction guesses a more traditional price target of $10-15.

Impact of a Potential Stock Split

One street that could refresh investor interest is a fintechzoom gme stock split. Stock splits make shares more accessible to retail investors by dropping the price per share, which could lead to improved liquidity and demand. While no stock split has been officially broadcast, the theory of closing the possibility has continued. If GameStop continues to struggle in its digital transformation, a split might be a strategic move to make its shares more beautiful to retail investors.

Counterarguments: The Risks of Relying on Digital Shifts

Digital-First Strategies: Success or Setback?

While GameStop’s shift to digital could pay off, it’s essential to allow the risks. One vital piece of advice against the digital pivot is GameStop’s late entry into the digital-first space. Competitors like Steam and Epic Games already have a strong position, offering extensive digital libraries, multiplayer networks, and online stores. FintechZoom GME stock forecast warns that GameStop could face a brutal battle in carving out a competitive niche in such a crowded market.

Moreover, GameStop’s past trust in retail, combined with a lack of significant investment in technology, raises questions about its ability to effect a successful digital transformation. fintechzoom gme stock prediction points to the possibility of a letdown if the company cannot build the technological structure required to compete with these traditional platforms.

The Meme Stock Legacy: Volatility and Uncertainty

Another challenge facing GameStop is its legacy as a meme stock. While the stock’s 2021 rise brought attention and short-term gains, it also brought volatility. This volatility may continue, leading to random price movements driven more by social media and retail investor soppiness than by actual business basics. For long-term investors, this could pose a critical risk.

Also Read: How Global News Impacts FintechZoom.com Bitcoin Price Predictions 2024

Conclusion

The company stands at a critical juncture as GameStop moves toward 2025-2030. Its ability to successfully transition to a digital-first business model will control whether it can regain its application in a rapidly changing industry. While challenges overflow—reaching from stiff competition in digital gaming to its meme stock legacy—there are also significant opportunities. A successful push into esports, subscription services, and cloud gaming could boost GameStop’s stock price and refresh its brand. Finally, the FintechZoom GME stock forecast offers careful optimism, suggesting that while the road fast will be difficult, investors should keep a close eye on the company’s strategic moves over the next time.

References

- FintechZoom. (2024). GME Stock Price History and Forecast. Retrieved from FintechZoom.com

- Business Insider. (2023). GameStop: Digital Sales and Future Prospects.

- CNBC. (2024). How Esports is Shaping the Future of Gaming.

- Bloomberg. (2024). Cloud Gaming and Subscription Models: A New Era for GameStop?

- Reuters. (2024). GameStop Stock: From Meme to Digital Transformation.

FAQs for FintechZoom GME Stock Forecast 2025-2030: Preparing for a Digital Shift

How much will GME stock be worth?

GME’s stock value by 2030 is difficult to predict due to market volatility and ongoing changes within the company. Optimistic plans from analysts suggest that if GameStop successfully pivots to digital models, the stock could steady around $30-$40 per share. Traditional estimates, however, indicate a range of $10-$15, given the risks associated with its transition. Investors should monitor key financials and digital creativities for more true predictions.

Who owns the most GME stock?

As of recent filings, official investors have held the popular fintechzoom GME stock. Notable owners embrace Front Group and BlackRock, each owning significant portions of the company. Ryan Cohen, GameStop’s Chairman, is also one of the largest individual owners, leading the company’s strategic shift toward e-business and digital creativities.

What is the actual value of GME?

Defining the “true” value of GME stock depends on several factors, including its skill to innovate and adjust to the digital age. Current valuation models consider the company’s ongoing financial struggles and lessening incomes, which suggest a lower primary value. However, if GameStop’s foray into digital markets, NFTs, and cloud gaming proves successful, the stock could see an upward adjustment in its essential value.

Is GME stock a good buy?

Whether GME is a good buy depends mainly on investment strategy and risk lenience. The stock remains highly volatile and notional, with its future reliant on successful digital transformation efforts. Since it is a “buy,” long-term investors may want to see more physical results from these shifts, while those interested in short-term market plays might exploit the stock’s volatility.

How does GameStop plan to succeed in digital gaming?

GameStop focuses on digital transformation through companies like NFT and blockchain gaming companies, potential esports projects, and exploring cloud gaming options. The company’s leadership objects to reducing trust in physical retail stores and shifting toward e-commerce and digital platforms. The success of these efforts will be critical to its future.

What were the key drivers behind GME’s 2021 stock surge?

Retail investors primarily drove the 2021 surge in gme stock fintechzoom on platforms like Reddit’s WallStreetBets, which orchestrated a short squeeze against institutional short-sellers. This led to unprecedented stock price gains, fueled by social media momentum rather than traditional business performance.

How does GameStop compare to digital-first competitors?

GameStop faces stiff competition from established digital gaming platforms like Steam, Epic Games, and PlayStation Store, which have strong footholds in the digital market. GameStop’s late entry into the digital arena and the dominance of these competitors make its transition challenging but possible, mainly if it carves out niche markets such as esports or NFTs.

Will GameStop perform a fintechzoom gme stock split?

Although speculation about a potential fintechzoom gme stock split exists, no official announcements have been made. A stock split could make shares more accessible to retail investors and increase trading volume, but it would not affect the company’s underlying valuation or business model.

FOR MORE EXCITING BLOGS PLEASE VISIT THE WEBSITE: fintechzoomproofficial.com