Table of Contents

The Walt Disney Company (NYSE: DIS) has been consistent capital in the acting industry in many areas. Despite fluxes in market trends, Disney has continued to adapt to new challenges, with its stock ahead of new interest among investors. With the rise of flowing platforms like Disney+, a growing focus on media and acting, and the potential for strategic stock splits, investors are keen to understand what the future holds for Disney’s stock. This article offers a complete FintechZoom Disney stock outlook for 2025, using in-depth analysis, financial trends, and expert predictions.

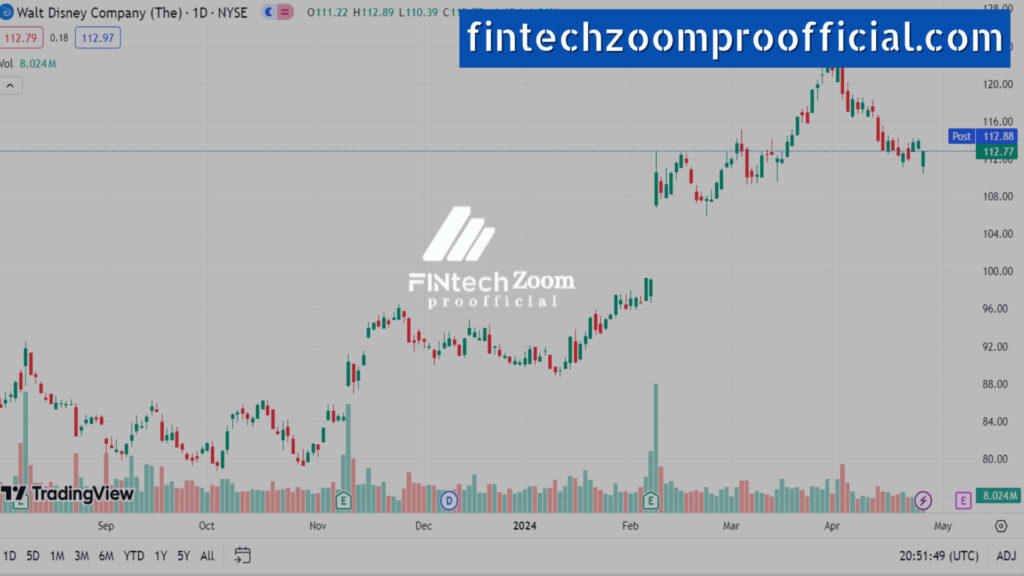

Disney’s Historical Stock Performance: Lessons for 2025

Disney’s stock price has grown significantly over the years, sparkling its skill to pivot into new markets and develop its reach. From its early days as an animation studio to its current media domain, Disney has continued a robust company in both acting and investor rings.

FintechZoom Disney stock price data tells us that Disney has not been safe from external shocks, especially the effects of sicknesssicknesss on its theme parks and trip lines. However, its hostile push into flowing and content creation through Disney+ has provided a new income stream. This innovation has stuck the FintechZoom Disney stock forecast, representing potential growth in 2025.

Disney’s ability to remain permanent even during economic dips offers lessons for investors. Based on past market responses, investors should expect Disney to continue adjusting to financial, technical, and positive challenges. The company’s strategic purchases (Marvel, Lucasfilm) and growth into digital platforms emphasize its elasticity, making it a top candidate for long-term stock performance.

Disney Stock Split: A Potential Catalyst for Growth?

Disney’s stock has seen splits, the last in 1998. As the stock price has increased again, investors have been concerned about the potential for another FintechZoom Disney stock split in the near future. Stock splits are often seen as a way for businesses to make their shares more accessible to a broader range of investors, improving liquidity and driving higher trading sizes.

History of Disney Stock Splits

Disney has applied stock splits during times of significant growth. Each split has resulted in greater market interest and confidence. For example, Disney’s 4-for-1 stock split 1998 folded its stock price within a year. If Disney splits its stock in 2025, it could be a catalyst for further growth.

Potential Impact of a Stock Split in 2025

A stock split in 2025 could lower Disney’s stock price, making it more affordable for retail investors. This move would likely boost investor soppiness and increase requests, resulting in a rise in FintechZoom Disney stock price. Stock splits also have the potential to impact market liquidity, with more common trading offering opportunities for both long-term investors and short-term traders.

While stock splits are typically positive, it’s vital to note that they don’t affect the company’s fundamental value. They only make shares more nearby to investors by dropping the price per share. But, a stock split can be an emotional signal that Disney forestalls further growth, making it an inviting option for those interested in who is buying Disney stock.

Key Trends Shaping Disney’s Future Stock Performance

Streaming Services and Media Expansion

Disney+ has been a critical force in Disney’s stock performance since its launch in 2019. With hostile plans to expand its content library, reach more international markets, and outpace competitors like Netflix and Amazon Prime, Disney+ is projected to drive significant growth. According to FintechZoom’s data, Disney’s stress on original content and logical goods (Marvel, Star Wars) will continue to fuel subscriber growth, making FintechZoomDisney stock a beautiful investment.

By 2025, Disney aims to reach 260 million global subscribers, which will lead to higher income and more solid stock performance. The continual growth of streaming platforms will likely be a major factor in the FintechZoom Disney stock forecast, mainly as additional content is created to attract new viewers and retain current readers.

Post-Pandemic Recovery of Theme Parks

Another dangerous factor in Disney’s stock growth is its global network of theme parks. While the disease strictly stuck park operations, visitor numbers have progressively risen as global limits eased. The commons serve as an essential income generator, and with the expected full recovery by 2025, Disney’s overall success will likely improve.

In addition to recovery, Disney has broadcast several new holds and growths, especially in Asia and Europe, to boost theme park income. As a result, the FintechZoom Disney stock price is expected to climb, as these growths explain.

Mergers, Acquisitions, and New Ventures

Blends and purchases have long been a strategy for Disney to stay ahead of the struggle. While its 2025 purchase plans are notional, possible targets in the betting, technology, or media sectors could promote Disney’s stock act. As Disney continues to vary its portfolio, it may project into virtual reality, increased reality, or the metaverse, giving it an edge in the digital acting market.

The purchase of new intelligent goods and projects into available markets could boost the FintechZoom Disney stock forecast as the company continues to innovate and expand. This trend will also affect Disney stock quote and market sentiment as investors assess future growth predictions.

Counterarguments: Challenges That Could Hinder Disney’s Stock Growth

Streaming Market Saturation

While Disney+ has enjoyed fast growth, the flowing market is gradually becoming crowded. Competitors such as Netflix, Amazon Prime, and HBO Max continue to control the site, and the emergence of niche-flowing platforms may lead to buyer weakness. If Disney cannot maintain its growth course in this sector, its stock price could fester or even wane.

Rebuttal: Disney’s expanded portfolio, which includes theme parks, options, and stock, provides multiple income streams. Even if streaming growth slows, these other possessions ensure that Disney remains financially stable, justifying any potential declines.

Economic Volatility

The stock market is often subject to external economic factors, including increases, interest rates, and global declines. Disney’s contact with international markets, mostly its theme park actions in Europe and Asia, means it could be weak to global economic slowdowns. These factors could harmfully impact FintechZoom Disney stock in the short term.

Rebuttal: Despite these worries, Disney’s strong brand credit and flexibility position it well to navigate economic challenges. Its long-term investment in technology and acting origination will likely offset short-term economic instability.

Conclusion: What Can Investors Expect for Disney Stock by 2025?

Disney’s stock outlook for 2025 is cut by a blend of advanced growth strategies, recovery from sickness, and possible mixes like stock splits. The analysis of FintechZoom Disney stock price data suggests confidence in the future, with key trends in streaming services, theme parks, and business purchases driving growth.

While there are possible risks related to market capacity and economic instability, Disney’s broad income streams and varied portfolio provide a safety net for investors. Whether Disney tools a stock split, the company’s long-term growth makes FintechZoom Disney stock a promising investment.

Investors should reflect on these insights wisely and consult financial experts before making any critical investment choices. Disney Leftovers is one of the most iconic brands in the world, and its stock performance over the next few years will likely continue to spark that status.

References

- APA or MLA citations for credible sources supporting the analysis, including industry reports, expert forecasts, and financial data.

Frequently Asked Questions (FAQ)

Is Disney an excellent stock to buy today?

Disney stock has been historically stable, with growth driven by its diversified business model, including streaming, theme parks, and media networks. However, it’s essential to consider external factors like economic volatility and market competition. Consulting FintechZoom data, Disney’s stock shows potential for growth through 2025, but investors should continually evaluate their financial goals and risk tolerance before making a decision.

Who owns the majority of Disney stock?

Most of Disney’s stock is owned by institutional investors, including Vanguard Group, BlackRock, and State Street Corporation. These large institutional investors play a significant role in Disney’s stock market behaviour, influencing stock price trends and market sentiment.

What was Disney’s stock at its highest?

Disney’s stock reached its all-time high in March 2021, peaking at approximately $203 per share. This surge was primarily driven by the success of Disney+ and the strong recovery of its media and entertainment segments.

What will Disney stock be worth in 5 years?

According to current trends and the FintechZoom Disney stock forecast, Disney’s stock is expected to grow steadily over the next five years. Analysts predict that, by 2025, Disney’s stock could see significant growth due to the expansion of Disney+, the recovery of theme parks, and potential acquisitions. However, predictions can vary, and monitoring economic conditions and industry trends is essential.

Will Disney split its stock in 2025?

While Disney has not officially confirmed a stock split, many investors speculate that it could happen soon, especially if the stock price continues to rise. A FintechZoom Disney stock split could make shares more affordable for a broader range of investors, boosting demand.

How does Disney’s streaming service affect its stock performance?

Since its launch, Disney+ has been pivotal in driving the company’s stock growth. By 2025, Disney+ is expected to contribute significantly to the company’s revenue, making FintechZoom Disney stock an attractive investment for those interested in the streaming market.

What factors could impact Disney’s stock negatively?

Several factors could hinder Disney’s stock growth, including streaming market saturation, economic downturns, or global regulatory changes. If the company fails to maintain its competitive edge in streaming or its theme parks suffer due to external challenges, these factors could negatively affect FintechZoom Disney stock price.

Who is buying Disney stock in 2024?

Disney stock continues to attract a mix of institutional and retail investors. Notable institutional buyers, such as Vanguard and BlackRock, hold significant shares of Disney stock. At the same time, individual investors are drawn to the company’s long-term growth prospects, particularly its media, entertainment, and digital ventures.

for more exciting blogs, please visit the website: fintechzoomproofficial.com

1 thought on “FintechZoom Disney Stock Outlook 2025: Promising Trends from FintechZoom Data”