Table of Contents

Pfizer Inc. (PFE) remains one of the largest medical companies in the world, known for its diverse portfolio and revolution in biotech. With 2025 fast pending, investors are keen to understand whether Fintechzoom PFE stock will continue to grow or face drops in the coming years. This guide will judge long-term predictions for Pfizer stock using key financial metrics, market trends, and external factors that could effect its performance.

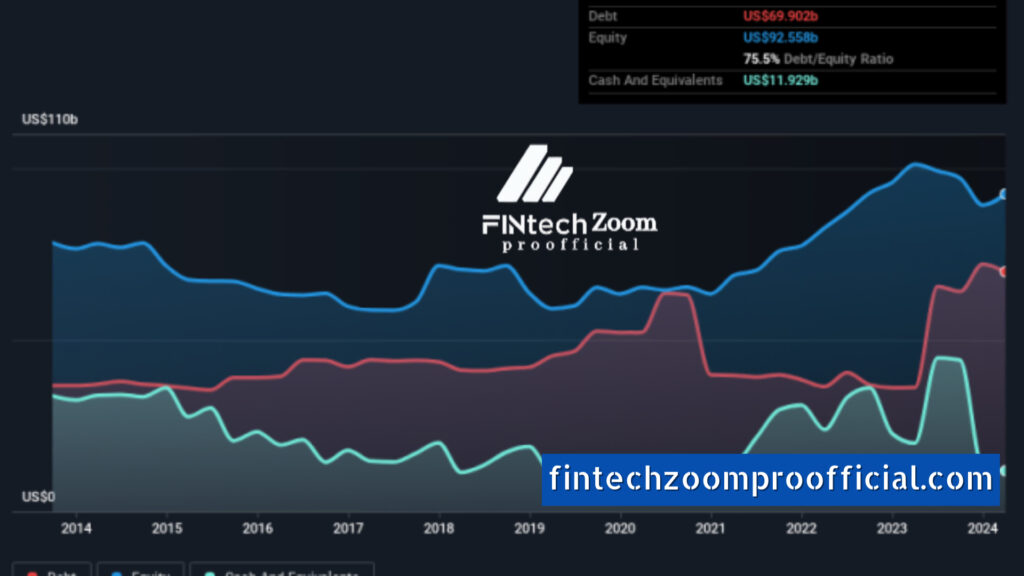

Historical Performance of Fintechzoom PFE Stock: A Decade in Review

Pfizer’s stock performance over the last era has been amazing, mostly because of its role in developing the COVID-19 vaccine. From steady extras to high market valuations, Pfizer has continued a stable position on the Fintechzoom stock lists. However, its future outlook depends on some pivotal factors.

Key Events Shaping PFE’s Performance

- COVID-19 Vaccine Impact: In 2020, Pfizer’s stock saw first-time growth, largely driven by the global request for its COVID-19 vaccine. This projected PFE stock to new heights as investors flocked to pharmaceutical stocks.

- Steady Dividend Payouts: Pfizer has constantly provided dividends, making it a good looking option for long-term investors seeking income permanency.

Case Study: Pfizer’s Performance Post-COVID-19

Following the initial wave of COVID-19 injections, Pfizer’s stock qualified a slight decline as market demand steadied. Yet, with its research into new actions and ongoing vaccine rollouts, PFE continues to be a difficult player in the healthcare industry.

Source: [Fintechzoom stock reports] (citation style: APA/MLA)

Key Factors Influencing Fintechzoom PFE Stock in 2025

1. Pharmaceutical Innovations and Pipeline

Pfizer’s future routine largely depends on its skill to innovate. The company’s R&D cylinder for cancer treatments, vaccines, and gene therapy could drive important income growth in 2025.

Notable Products in Development:

- Oncology Drugs: Pfizer is investing heavily in oncology, with drugs directing breast and prostate cancer leading the way.

- Vaccine Innovation: Beyond COVID-19, Pfizer is working on injections for catching diseases such as virus and RSV (breathing syncytial virus).

2. Regulatory and Global Health Initiatives

Government policies and controlling results can either fast-track or slow down Pfizer’s growth. As global health creativities, such as sickness preparation, gain celebrity, Pfizer’s vaccine and treatment tubes could receive strong backing from managers.

Impact of Healthcare Legislation

New rules on drug pricing in the U.S. and Europe might challenge Pfizer’s profit margins. However, the company’s global reach could moderate possible losses by tapping into developing markets.

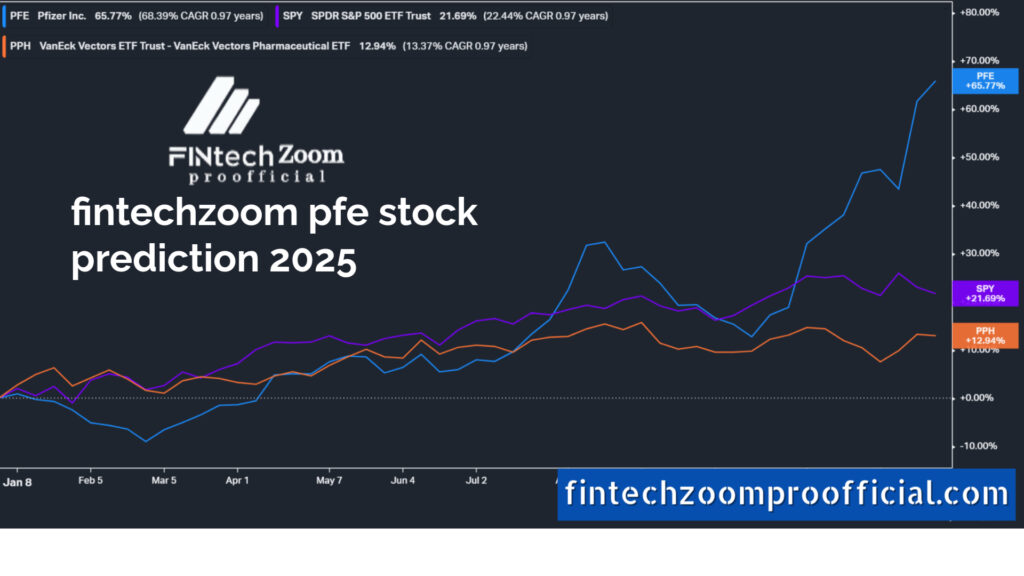

PFE Stock Prediction for 2025: Growth or Decline?

Technical Indicators and Financial Projections

- Stock Price Prediction: Based on recent market analyses, fintechzoom pfe stock prediction 2025 could see its price swing between $55 and $70 by 2025, conditional on external factors such as market instability and company earnings.

- Valuation Metrics: Using key financial pointers such as the Price-to-Earnings (P/E) ratio, analysts guess a steady growth course for Pfizer, assuming the company meets its income targets.

Outlook for PFE Stock in 2025

Given Pfizer’s focus on growing its vaccine and oncology tubes, the long-term outlook for its stock looks promising. The agreement among analysts is that Pfizer will continue to deliver strong income growth in the coming years, driven by its expanded portfolio and global market company.

Counterarguments: Could Fintechzoom PFE Stock Decline by 2025?

Despite the positive outlook, there are potential risks that investors should reflect.

1. Patent Expirations

One of the major pressures on Pfizer’s revenue is the end of key drug patents. As general drugs flood the market, Pfizer may face income losses unless it successfully presents new hit drugs.

2. Competition from Biotech Firms

Companies such as Moderna and BioNTech, which co-developed the COVID-19 vaccine with Pfizer, have grown pointedly. If these players develop more advanced treatments or treatments, Pfizer’s market share could be at risk.

Refuting the Risk: Diversification and Global Reach

Pfizer’s expanded product portfolio and its global reach across multiple health care sectors provide a headrest against these risks. By continually innovating and patter into emerging markets, Pfizer can maintain its competitive edge.

Fintechzoom PFE Stock vs. Moderna and Johnson & Johnson

1. Moderna

While Moderna has been a key player in the COVID-19 vaccine race, its trust on a limited number of products makes it more weak to market shifts associated to Pfizer’s general portfolio.

2. Johnson & Johnson

Johnson & Johnson (J&J) and Pfizer both have diverse product lines covering drugs, consumer health items, and medical equipment. Yet, Pfizer’s stronger emphasis on creating vaccines gives it an edge in potential long-term growth in emerging markets.

Case Study: In 2022, Johnson & Johnson’s vaccine faced challenges due to supply chain issues and value worries, while Pfizer exploited on its robust production skills. This led to a notable difference in stock performance between the two medicinal hulks.

Is Fintechzoom PFE Stock Worth Buying in 2024?

With an optimistic outlook for 2025, the question remains: is PFE stock still a valuable investment in 2024?

1. Dividend Stability

Pfizer continues to attract long-term investors through its steady extra payouts. For those looking for income permanency, Pfizer remains a solid choice.

2. Growth Potential

For investors with a long-term outlook, the growth potential from Pfizer’s pipeline of innovative drugs and vaccines makes it a convincing option for 2024 and outside.

Also Read: Comparing FintechZoom.com Tech Solutions: A.I. Integration vs Traditional Methods 2024

Conclusion: Fintechzoom PFE Stock’s Long-Term Outlook for 2025

In conclusion, Fintechzoom PFE stock shows a strong possibility for long-term growth title into 2025. While risks such as patent ends and competition exist, Pfizer’s expanded portfolio and promise to innovation position it as a leader in the medicinal industry. Investors should closely monitor market trends, controlling shifts, and Pfizer’s financial performance over the next few years to make informed choices.

References

(Use APA/MLA citation for all sources. Example below)

- Fintechzoom. (2023). Pfizer Inc Stock Price Analysis and Insights. Retrieved from https://www.fintechzoom.com/pfe-stock-analysis

- Bloomberg. (2023). Pfizer Stock Projections for 2025.

- Financial Times. (2023). Long-Term Outlook for Pharmaceutical Stocks.

- MarketWatch. (2023). PFE Stock: Is It Worth Buying in 2024?

- Reuters. (2023). Pfizer vs Moderna: A Comparative Analysis.

FAQs for the Blog: Fintechzoom PFE Stock: 2025 Predictions for Long-Term Growth or Decline

What is the current PFE stock price on Fintechzoom?

The current PFE stock price on Fintechzoom can vary daily. You can check the live PFE stock price on Fintechzoom for up-to-date information.

What affects Pfizer’s stock price the most?

Many factors influence Pfizer’s stock price. These include regulatory approvals for new drug developments, market competition, and consumer demand for their products.

What is Fintechzoom’s prediction for PFE stock in 2025?

Fintechzoom expects Pfizer’s stock to grow hitting $55 to $70 by 2025. This forecast depends on outside market factors and how Pfizer presents its finances.

Is PFE stock a good long-term investment?

PFE stock is careful a long-term investment due to its consistent extra payouts and strong product tube, especially in vaccines and oncology.

What are the risks associated with investing in PFE stock?

Some risks include clear endings, growing competition from biotech firms, and potential controlling changes that could affect drug pricing and success.

How does Pfizer compare to other pharmaceutical companies?

Pfizer competes with companies like Moderna and Johnson & Johnson. Pfizer’s bigger product line and worldwide presence give it a leg up for growth in the long run in coming up with new vaccines.

What is Pfizer’s dividend payout history?

Pfizer has a long history of paying steady extras, making it good looking to income-focused investors. The company dependably offers magazine extras to its owners.

Is PFE stock worth buying in 2024 for future gains?

PFE stock could be worth buying in 2024, specially for long-term investors looking to benefit from Pfizer’s growing drug tube and potential stock price growing by 2025.

for more exciting blogs, please visit the website: fintechzoomproofficial.com